|

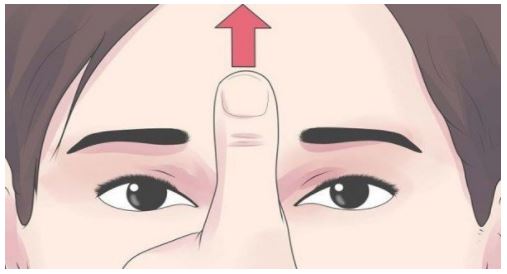

| Pijat Titik Ini Untuk 45 Detik !!! Dan Anda Akan Terkejut Melihat Hasilnya..!!! ((SUNGGUH MENAKJUBKAN)) |

For thousands and thousands of Individuals, paying for school means stitching collectively a patchwork of loans from completely different sources. Sadly, that may be annoying after commencement. Having half a dozen payments come due at completely different occasions every month makes it laborious for graduates to maintain monitor of what they owe and the way a lot curiosity they’re paying. Lacking only one cost can put a giant dent on their credit score scores.

One answer is to consolidate pupil loans right into a single month-to-month invoice. Consolidating pupil loans can decrease month-to-month funds and may make it quicker and simpler to get out of debt. Not all pupil loans might be consolidated, however refinancing presents related advantages for individuals whose loans don’t qualify.

What's the distinction between consolidating and refinancing pupil loans?

Technically, solely federal loans might be consolidated, and it may well solely be achieved by way of a Direct Consolidation Mortgage from the U.S. Division of Schooling. When individuals go to a personal financial institution to bundle a number of loans right into a single cost, it’s referred to as

refinancing.

Federal consolidation and personal refinancing are related in some ways.

Each substitute a number of loans with a single month-to-month invoice.

Each permit debtors to shorten or lengthen the payback time.

Each permit debtors to decide on a brand new servicer.

Each lead to a brand new mortgage.

Each permit debtors to shorten or lengthen the payback time.

Each permit debtors to decide on a brand new servicer.

Each lead to a brand new mortgage.

Variations between consolidation and refinancing embrace:

Solely federal pupil loans might be consolidated, however each federal and personal pupil loans might be refinanced.

Should you consolidate federal loans, you stay eligible for many income-based reimbursement plans and mortgage forgiveness applications, however you can not decrease your rate of interest. The rate of interest can be a weighted common of the underlying charges on the outdated loans.

Should you refinance pupil loans with a personal firm, you lose entry to federal income-based reimbursement plans and mortgage forgiveness applications, however would possibly you have the ability to get a decrease rate of interest and get monetary savings.

Which pupil loans might be consolidated?

The federal authorities presents a Direct Consolidation Mortgage for many loans together with:

Direct Backed Loans

Direct Unsubsidized Loans

Backed Federal Stafford Loans

Unsubsidized Federal Stafford Loans

Direct PLUS Loans

PLUS loans from the Federal Household Schooling Mortgage (FFEL) Program

Supplemental Loans for College students (SLS)

Federal Perkins Loans

Federal Nursing Loans

Well being Schooling Help Loans

and a few present consolidation loans

Direct Unsubsidized Loans

Backed Federal Stafford Loans

Unsubsidized Federal Stafford Loans

Direct PLUS Loans

PLUS loans from the Federal Household Schooling Mortgage (FFEL) Program

Supplemental Loans for College students (SLS)

Federal Perkins Loans

Federal Nursing Loans

Well being Schooling Help Loans

and a few present consolidation loans

To steps to consolidate federal loans are pretty simple. Consolidation can mix your entire loans right into a single cost. Nevertheless, it is not going to decrease your rate of interest or lower your total prices.

Different personal and federal loans might be consolidated by refinancing. You may mix a number of loans into one invoice and probably get a decrease rate of interest and extra favorable phrases, particularly in case you have a superb credit standing. Nevertheless, should you refinance federal loans with a personal lender, you'll lose income-based reimbursement and forgiveness choices.

When are you able to consolidate pupil loans?

When are you able to consolidate pupil loans?

Federal loans can’t be consolidated till after you graduate, go away faculty, or drop beneath half-time enrollment. Non-public loans might be refinanced any time, together with whilst you’re nonetheless at school

Are you able to consolidate a mortgage that's in default?

Presumably. Consolidation received’t take away the default out of your credit score report, however a Direct Consolidation Mortgage might help you get most federal loans again on monitor. Non-public loans which might be in deferment or forbearance is perhaps eligible for consolidation by way of refinancing, however personal loans which might be in default usually are not. When you've got missed funds in your personal loans, it's best to contact your lender or servicer as quickly as attainable to debate reimbursement choices.

Subsequent steps

Managing a number of pupil loans might be sophisticated and time consuming. At the moment, there are extra choices than ever to streamline your funds and map pathway out of debt. It solely takes 15 minutes to discover your consolidation and refinancing choices.